Are you ready to dive into the dynamic world of investing? The stock market can seem like an intricate maze filled with opportunities and challenges. For many, it represents a chance to grow wealth, secure financial futures, or even pursue dreams that once felt out of reach. But how do you get started on this exciting journey? Whether you’re curious about trading stocks or just want to learn more about managing your finances effectively, understanding the stock market is essential. Let’s explore what it is all about and how you can make informed investment decisions that align with your goals. Get ready to unravel the mysteries of https://finanzasdomesticas.com/bolsa-de-valores!

What is the Stock Market?

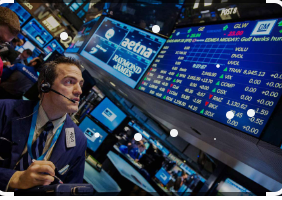

The stock market https://finanzasdomesticas.com/bolsa-de-valores is a platform where investors buy and sell shares of publicly traded companies. It acts as an exchange, facilitating the flow of capital between businesses seeking funds and individuals looking to invest.

When you purchase a share, you acquire a small ownership stake in that company. This means that your financial fate is tied to its performance. If the company thrives, so does your investment.

Stock markets operate through various exchanges like the New York Stock Exchange or Nasdaq. These platforms ensure transactions happen efficiently and transparently.

Market fluctuations occur due to numerous factors—economic indicators, political events, or even social trends can influence prices. Understanding these elements helps investors make informed choices about when to buy or sell stocks.

Engaging with the stock market opens doors to potential wealth creation while offering insights into global economic dynamics.

Benefits of Investing in the Stock Market

Investing in the stock market https://finanzasdomesticas.com/bolsa-de-valores opens up a world of possibilities. One of the main benefits is the potential for high returns. Historically, stocks have outperformed many other investment types over long periods.

Another advantage is liquidity. Unlike real estate or collectibles, selling your shares can happen quickly when needed. This access to cash offers flexibility during unexpected financial needs.

Moreover, investing in stocks allows you to participate in company growth. As businesses thrive and expand, so does your investment’s value.

There’s also dividend income to consider—many companies share profits with their investors through dividends, providing an additional revenue stream.

Engaging with the stock market fosters financial literacy. Understanding how markets function can empower you to make informed decisions about future investments and personal finance strategies.

Understanding Stocks, Bonds, and Mutual Funds

Stocks https://finanzasdomesticas.com/bolsa-de-valores represent ownership in a company. When you buy shares, you’re essentially purchasing a piece of that business. If the company performs well, your investment can grow.

Bonds are different; they’re loans made to corporations or governments. When you invest in bonds, you receive regular interest payments and get your principal back at maturity. They tend to be less risky than stocks but also offer lower returns.

Mutual funds pool money from many investors to buy a diversified portfolio of stocks and bonds. This approach spreads risk across various assets and is managed by professionals who make investment decisions on behalf of the fund’s shareholders.

Understanding these three options helps investors tailor their strategies based on risk tolerance and financial goals. Balancing between them can lead to more stable growth over time while navigating market fluctuations with confidence.

Steps to Start Investing in the Stock Market

Starting your journey in the stock market can feel overwhelming, but it doesn’t have to be. Begin by setting clear financial goals. Ask yourself what you want to achieve—are you saving for retirement or a big purchase?

Next, educate yourself about different types of investments. Familiarize yourself with stocks, bonds, and mutual funds. Each has its own risk and return profile.

Once you’re informed, choose an investment account that suits your needs. Look into brokerage options that offer user-friendly platforms and low fees.

Then comes the fun part: funding your account. Transfer money into it regularly to build up your investment capital over time.

Start small with your initial investments. Consider diversifying across various sectors to spread out risk while gaining exposure to potential growth opportunities.

Researching and Choosing Stocks to Invest In

Researching stocks is crucial for successful investing. Start by looking at a company’s fundamentals, such as earnings growth, revenue trends, and debt levels. These indicators provide insight into the health of a business.

Next, examine industry trends. Understanding market dynamics helps identify companies with strong potential. For example, technology and renewable energy sectors have shown significant growth in recent years.

Don’t overlook qualitative factors either. Management effectiveness and company culture can impact stock performance over time. Reading analyst reports or listening to earnings calls gives deeper insights into these aspects.

Consider your investment goals and risk tolerance when selecting stocks. Diversifying your portfolio across various sectors mitigates risks associated with market volatility while enhancing long-term gains.

Tips for Successful Investing in the Stock Market

Successful investing requires a blend of strategy and discipline. Start by setting clear financial goals. Define what you want to achieve in both the short and long term.

Diversification is crucial. Spread your investments across various sectors to reduce risk. This way, if one sector underperforms, others can balance your portfolio.

Stay informed about market trends and economic news. Knowledge is power in the stock market arena.

Consider adopting a dollar-cost averaging approach. Investing a fixed amount regularly can mitigate the effects of market volatility.

Avoid emotional decision-making; stick to your plan even when temptations arise during market fluctuations.

Review your investments periodically but avoid overreacting to short-term changes. A well-thought-out strategy will guide you through ups and downs alike.

Conclusion: The Importance of Diversifying Your Investments

Diversifying your investments is essential for minimizing risk and enhancing potential returns. By spreading your money across different asset classes, such as stocks, bonds, and mutual funds, you can reduce the impact of any single investment’s poor performance on your overall portfolio.

Consider a mix of industries when selecting stocks. This approach helps cushion against market volatility. The stock market can be unpredictable; having a diverse set of investments allows you to navigate uncertainties more effectively.

Additionally, regularly reviewing and rebalancing your portfolio ensures that it aligns with your financial goals as circumstances change. Remember to stay informed about market trends and shifts in various sectors.

Balancing growth-oriented assets with stable ones creates a solid foundation for long-term success in investing. Embrace diversification as part of your strategy to build wealth while managing risks wisely in the world of finance.